Juul Labs claimed Thursday that it had obtained funding from early investors and that it planned to slash off about a third of its workforce in order to stay afloat.

“Today, Juul Labs has established a path ahead, made possible by a cash infusion from some of our very first investors,” a Juul representative told CNBC. “With this financing, Juul Labs will be able to keep running its business, pursue its administrative appeal of the FDA’s marketing denial decision, and promote product innovation as well as science generation.”

The corporation has not disclosed any information about the investment or its terms.

Juul announced that in order to carry forward and remain operational, it will need to “reorganize” its global staff. The company intends to lay off approximately 400 workers and reduce its operational budget by 30 percent terms to 40 percent.

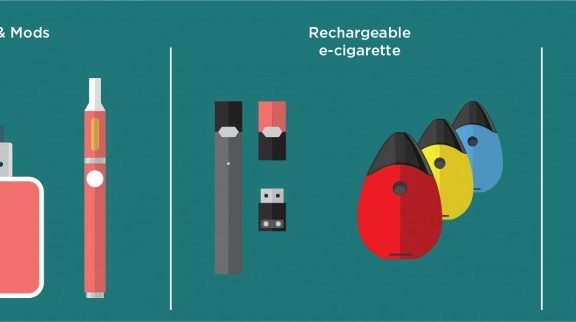

Juul has experienced financial difficulties in recent times. It launched its popular electronic cigarette in 2015, marketing it as a better alternative to smoking regular cigarettes. Ever since the firm has faced a number of legal issues. Juul resolved many substantial complaints launched by state authorities, most of which alleged misleading marketing techniques and a failure to warn about the dangers of its goods.

The agreement came ahead of recent research from the Food and Drug Administration and the Centers for Disease Control and Prevention, which found that electronic cigarettes would be the most widely used nicotine product among middle and high schoolers for the ninth consecutive year in 2022. Based on the agencies, approximately 3.1 million pupils consumed tobacco products this school year. E-cigarettes were used by over 2.5 million people.

According to the study, various factors, including tastes, advertising, and misconceptions of risk, lead to teenage tobacco product usage.

The FDA directed Juul to stop supplying its vaping devices this year, but the order was temporarily halted in July. The company’s bottom line suffered as a result of the headwinds, and analysts projected that it would seek bankruptcy protection under Chapter 11 as a way out.